Market Briefing

AI-written summaries delivered three times per day, covering index futures, sector rotation, notable movers, and the narrative behind the tape— giving you the “morning note” without writing one.

SignalDock monitors global markets, options flow, and your personal watchlist— then turns it all into concise briefings, ranked snapshots, and deep-dive analytics so you instantly see what matters and why.

No credit card required. Set your symbols once—SignalDock keeps you updated every session.

Watch a quick tour of SignalDock’s features.

Choose your core futures, equities, watchlist categories, and pairs. SignalDock builds structured analytics, rankings, and diagnostics around that universe automatically.

Receive market briefings, options reports, trading snapshots, and watchlist diagnostics at key session times—capturing the open, midday shifts, and the close without constant monitoring.

Use dashboards and email summaries to see which names truly moved, what drove the action, and how it fits your strategy—so your time goes into decisions, not data wrangling.

Try the interactive guide to see how SignalDock would structure your trading day and deliver what matters — without watching markets all day.

AI-written summaries delivered three times per day, covering index futures, sector rotation, notable movers, and the narrative behind the tape— giving you the “morning note” without writing one.

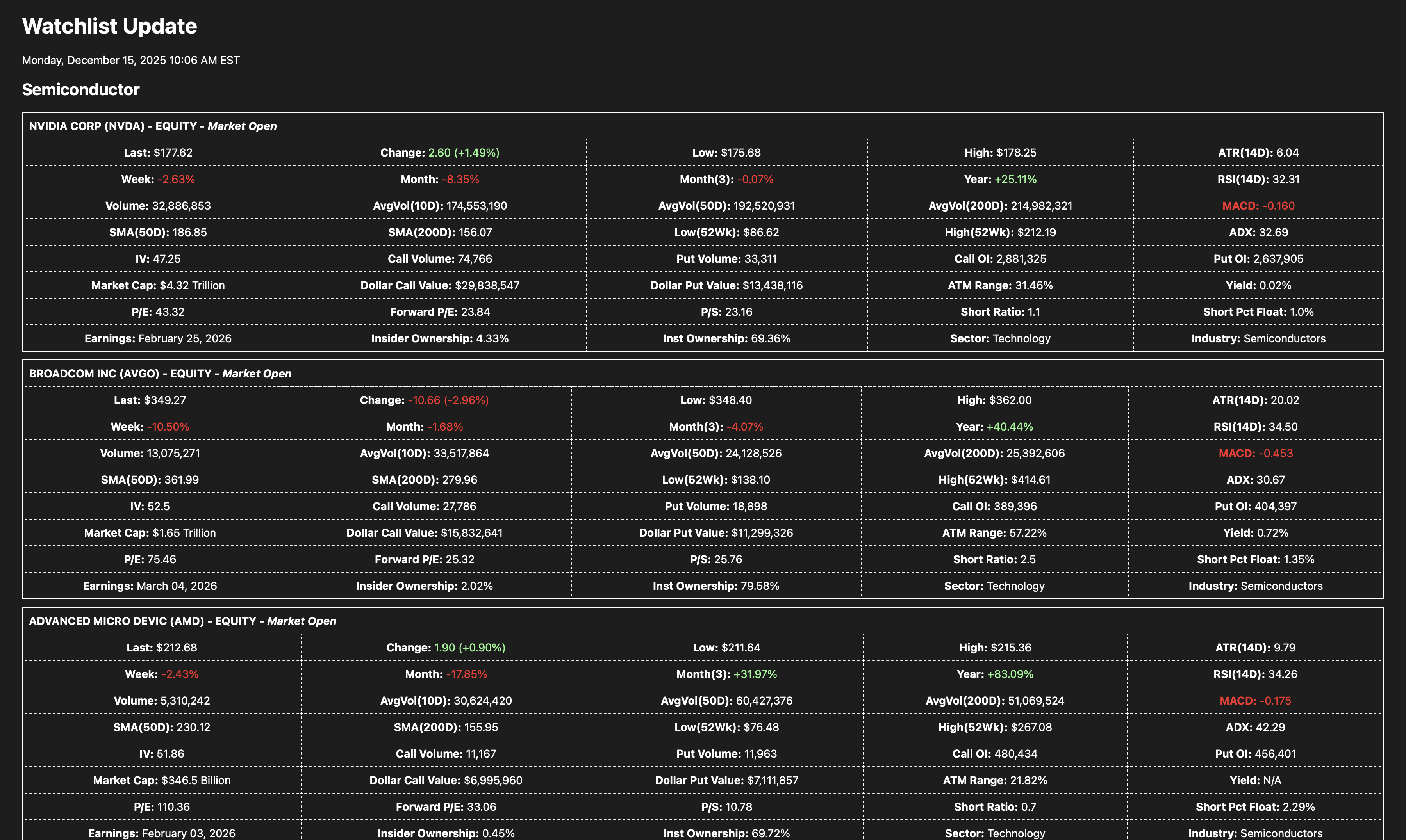

Category-based watchlists with quick signals for trend, volatility, strength, and volume—helping you track themes and spot regime shifts. Pairs with Movement Analysis for full technical commentary.

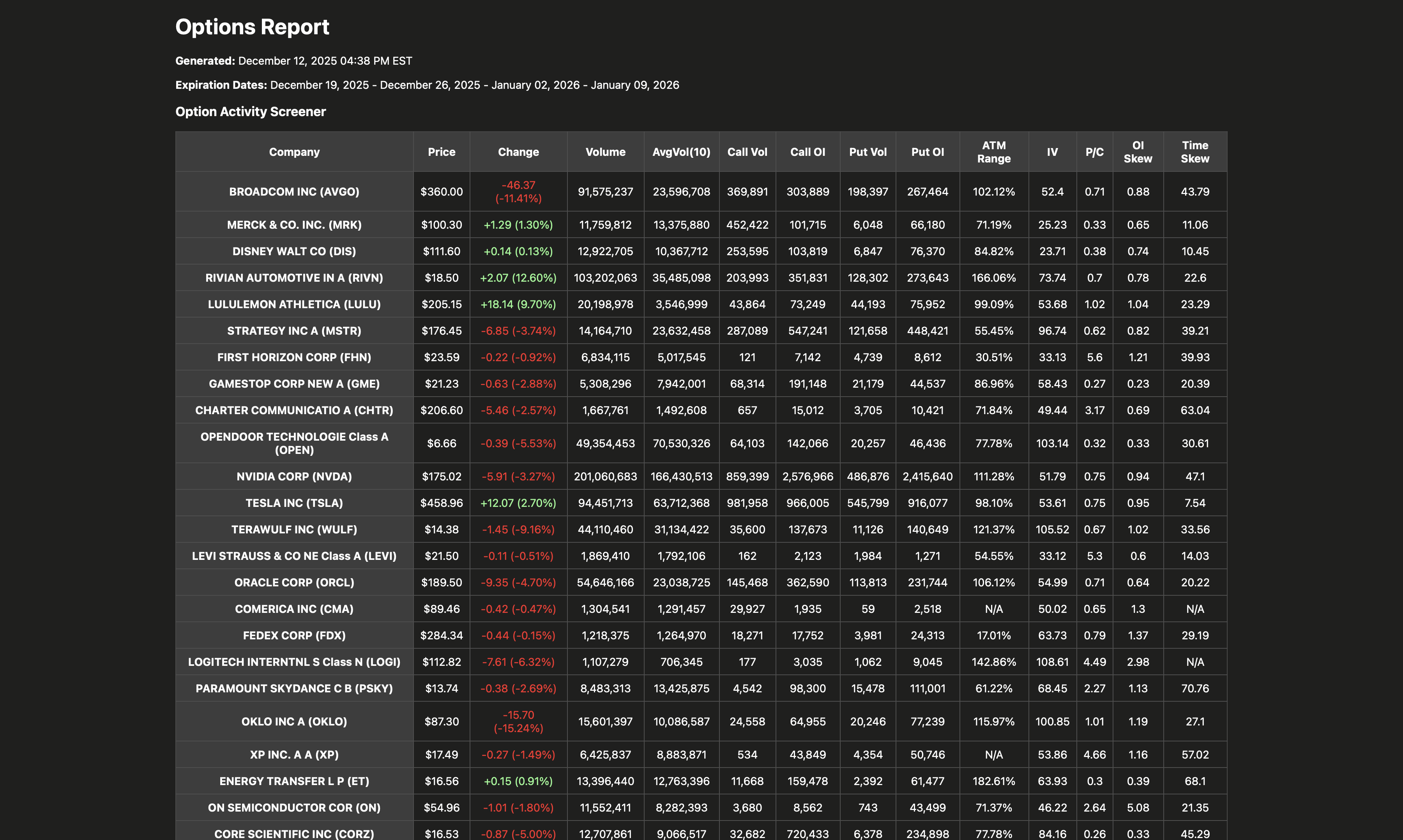

Intraday scan of the most active and unusual options flow, highlighting high-volume names, volatility shifts, and call/put positioning that can flag where larger investors are leaning before it appears in price.

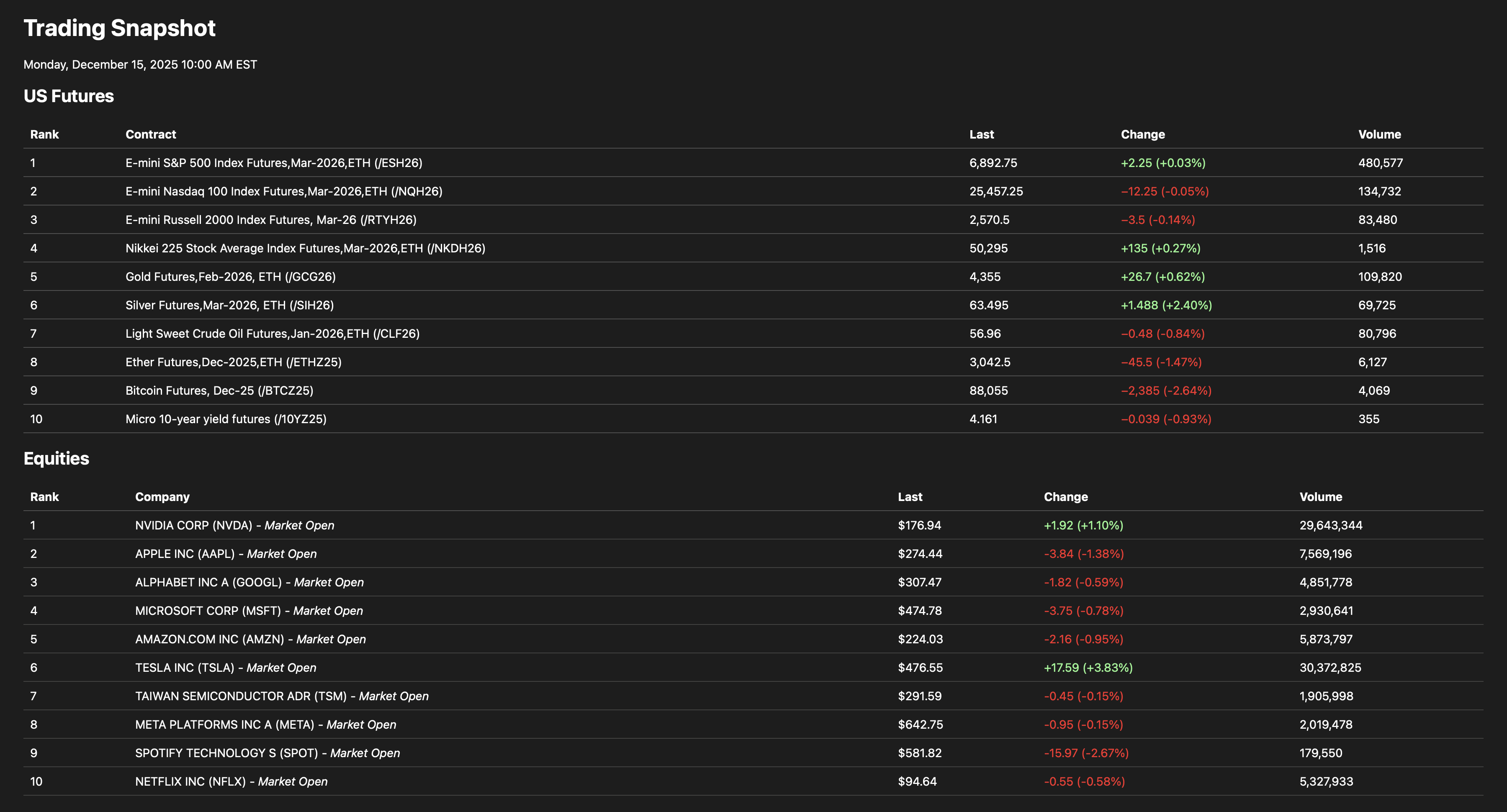

Ranked view of your key futures and equities showing price, percent change, and volume—so you instantly see where participation, momentum, and liquidity are concentrating.

On-demand technical and risk profile for any symbol—covering trend structure, volatility and drawdowns, long-run performance metrics, and forward price distributions via Monte Carlo simulations.

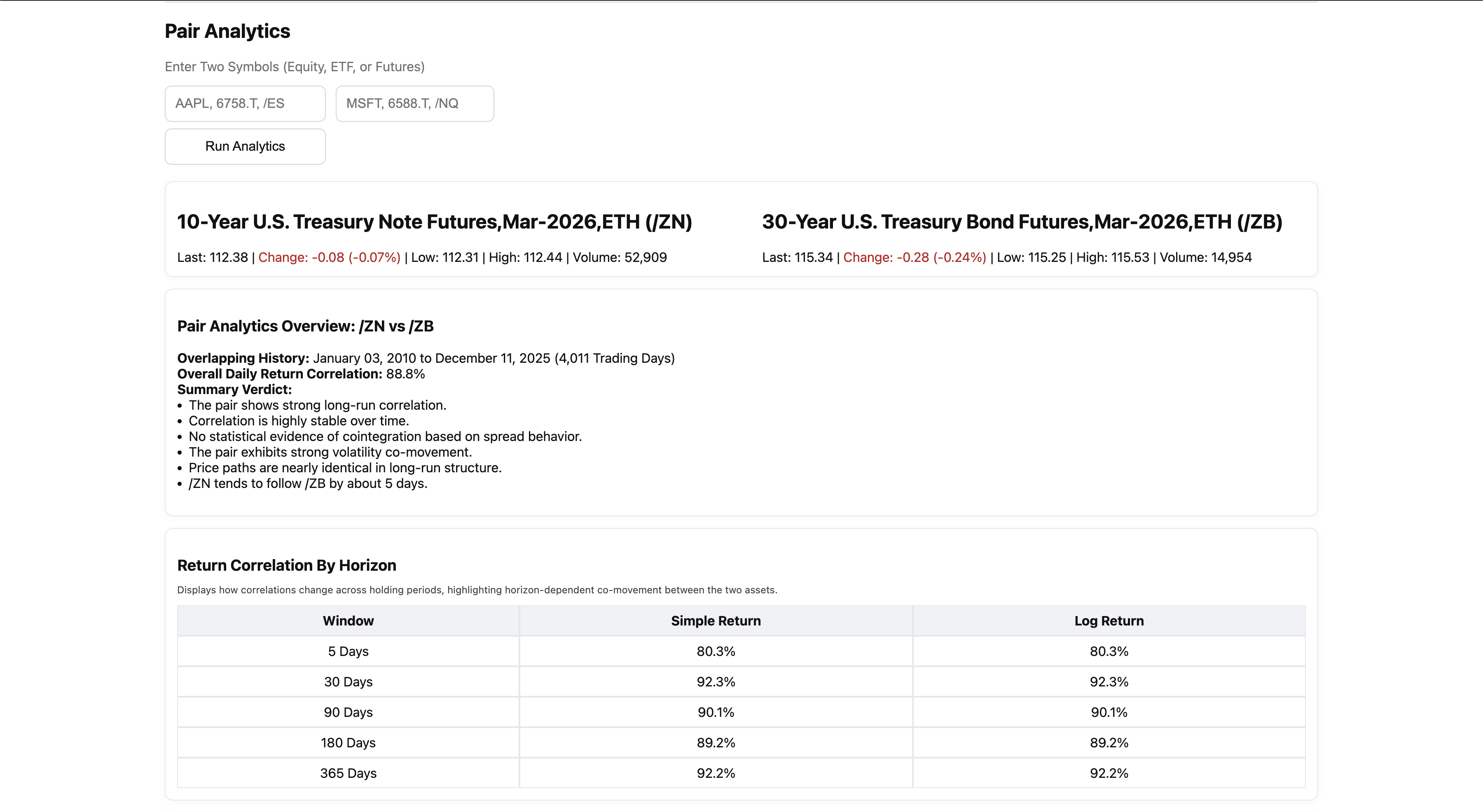

Cross-asset analytics measuring correlation by horizon, volatility co-movement, spread behavior, lead/lag timing, and hedge ratios—built for relative-value and hedged-book trades.

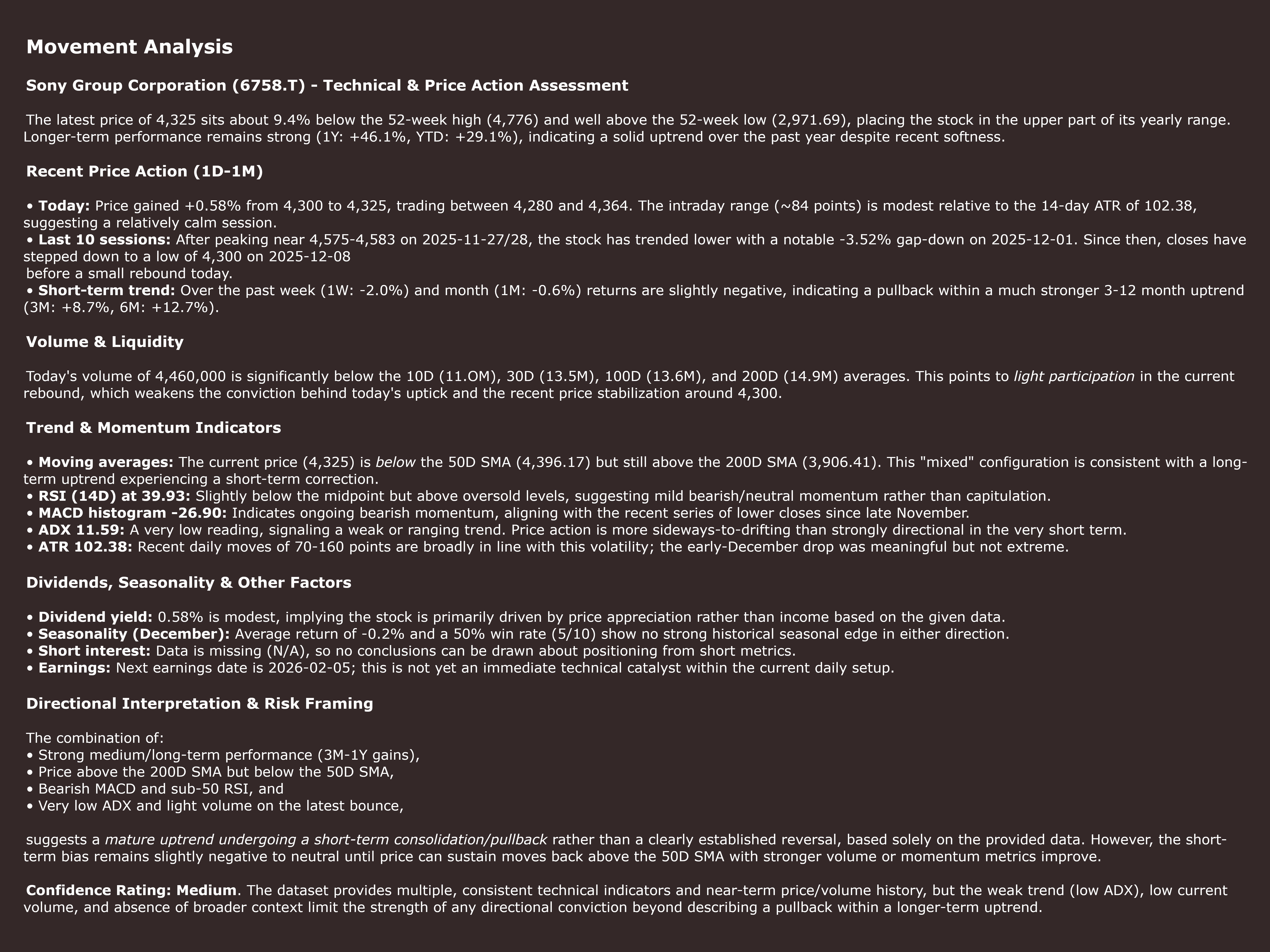

A focused technical and price-action note for individual names in your watchlist. Movement Analysis turns raw price, volume, and volatility into concise trading commentary so you can quickly decide which symbols deserve time and capital.

Movement Analysis is a premium add-on that sits directly on top of your Watchlist Update data, grounding every note in the way your names trade.

Here’s an example of what lands in your inbox. Each briefing highlights:

Create an account to start receiving these briefings and dashboards.

Join investors and traders using SignalDock to turn noisy markets into a focused, repeatable daily plan.